Default

Innovative Process Allowing Upgrade Owner Search to Insurable Foreclosure Search

Consistent Provider from Acquisition to Disposition

Reduce Counterparty Risk of Missed Liens/Judgments

Saves ~ $700 Per Transaction

Proprietary Title Consolidation Model

We understand the complexities that arise during foreclosure and title transfers. Our dedicated Default Title Services division supports servicers, attorney, and trustees by saving valuable time and costs associated with ordering multiple title reports.

Valor is committed to providing efficient, accurate, and reliable support, ensuring that the title process is handled smoothly from start to finish.

Why Valor - Risk Diversification Across Multiple Underwriters

As an approved agency for the nation's largest provider, we deliver the best execution rates for sellers by providing lowest price national underwriter, not just preferred or appointed underwriter as our local competitors.

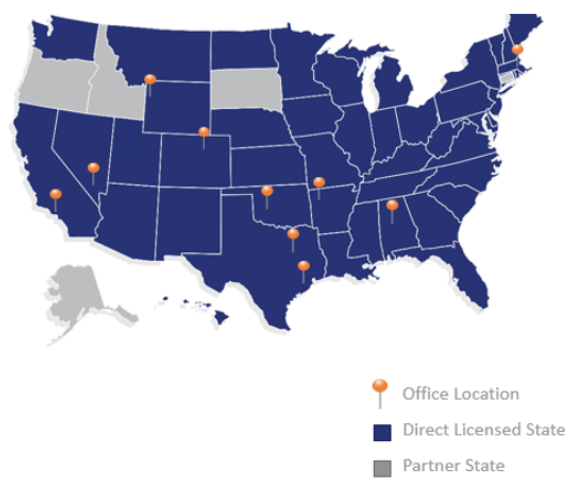

Valor Mortgage Services is licensed in 46 States and provides Service in Workshare States. We offer:

- Industry Veterans offering single point of contact

- Streamlined process and integrated technology

- Eliminate duplicate & unnecessary title reports

- Access single statutory search at fraction of the cost

Default Title & REO Products

Title report and Title Grading

Title report and Title Grading

Title examination for potential problems - lien position, legal/vesting, and tax & judgments

Graded report detailing recording issues

Remediate issues to avoid costly delays

Auction & REO Disposition

Auction & REO Disposition

Flexible for any transaction (3rd party auction, agent)

Coordinate with all parties to ensure a timely closing

Individual and bulk REO title insurance products

Settlement and disbursement services

Supplementary Risk Management

Ascertain quality, identify collateral risk and remedy issues resulting in enhanced portfolio performance